Financial Materiality

AI Tool

Quantify materiality of financial and ESG factors to truly leverage the full potential of your datasets and vendors

Our Key Features

Materialize investment advantages by uncovering performance and risk drivers

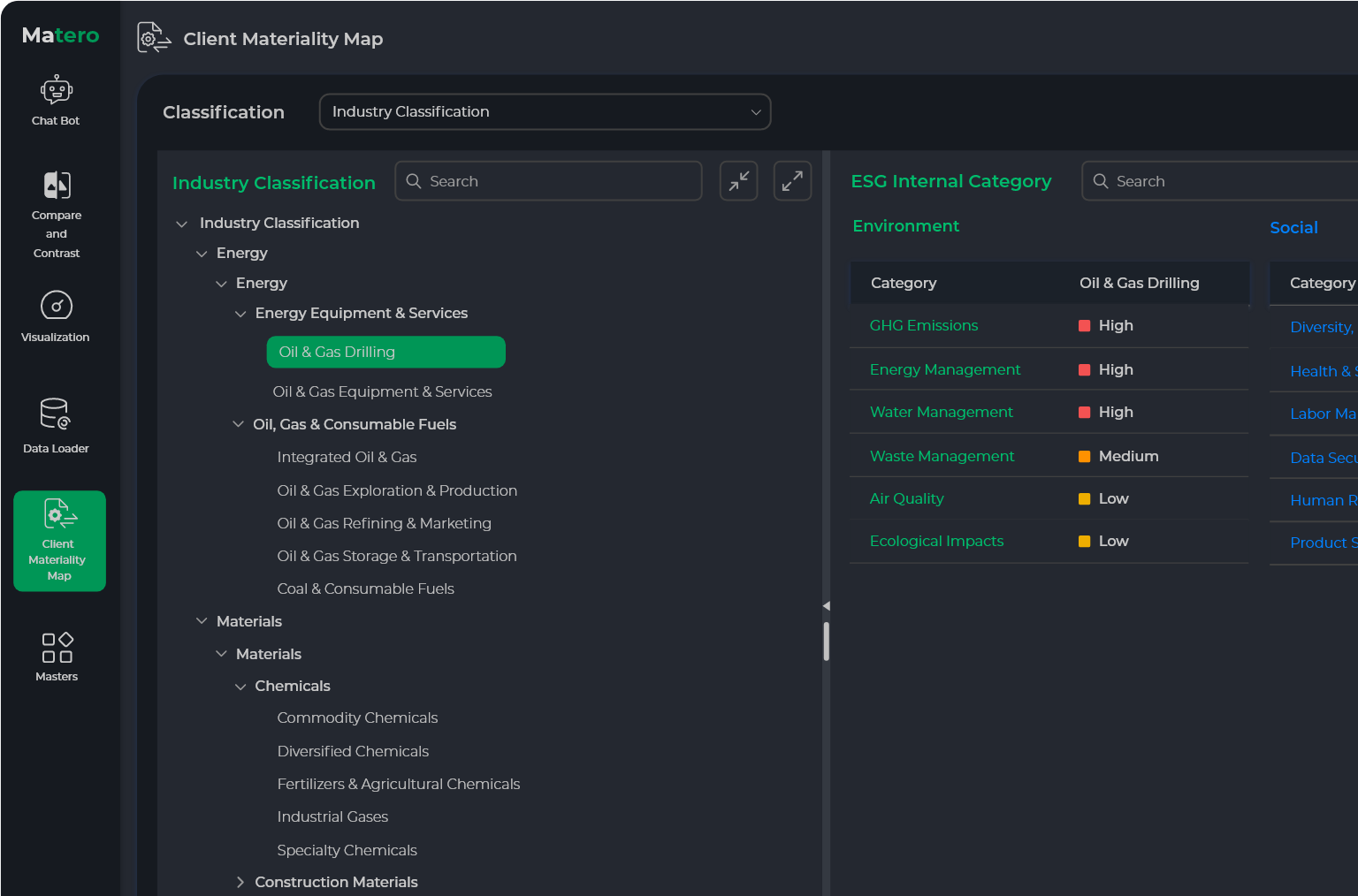

Industry Classification

Build your firm’s materiality maps to guide investment teams to identify issues within specific industries that may affect financial performance

Your ESG + AI + Quant Analyst

Trained models in investments and sustainability analyzing millions of datapoints to receive curated analysis, filtering out the noise for relevant, actionable investment information

Approved by CTOs

Locally installed custom large-language models allow your proprietary and sensitive data to remain in-house preventing leaks to external organizations

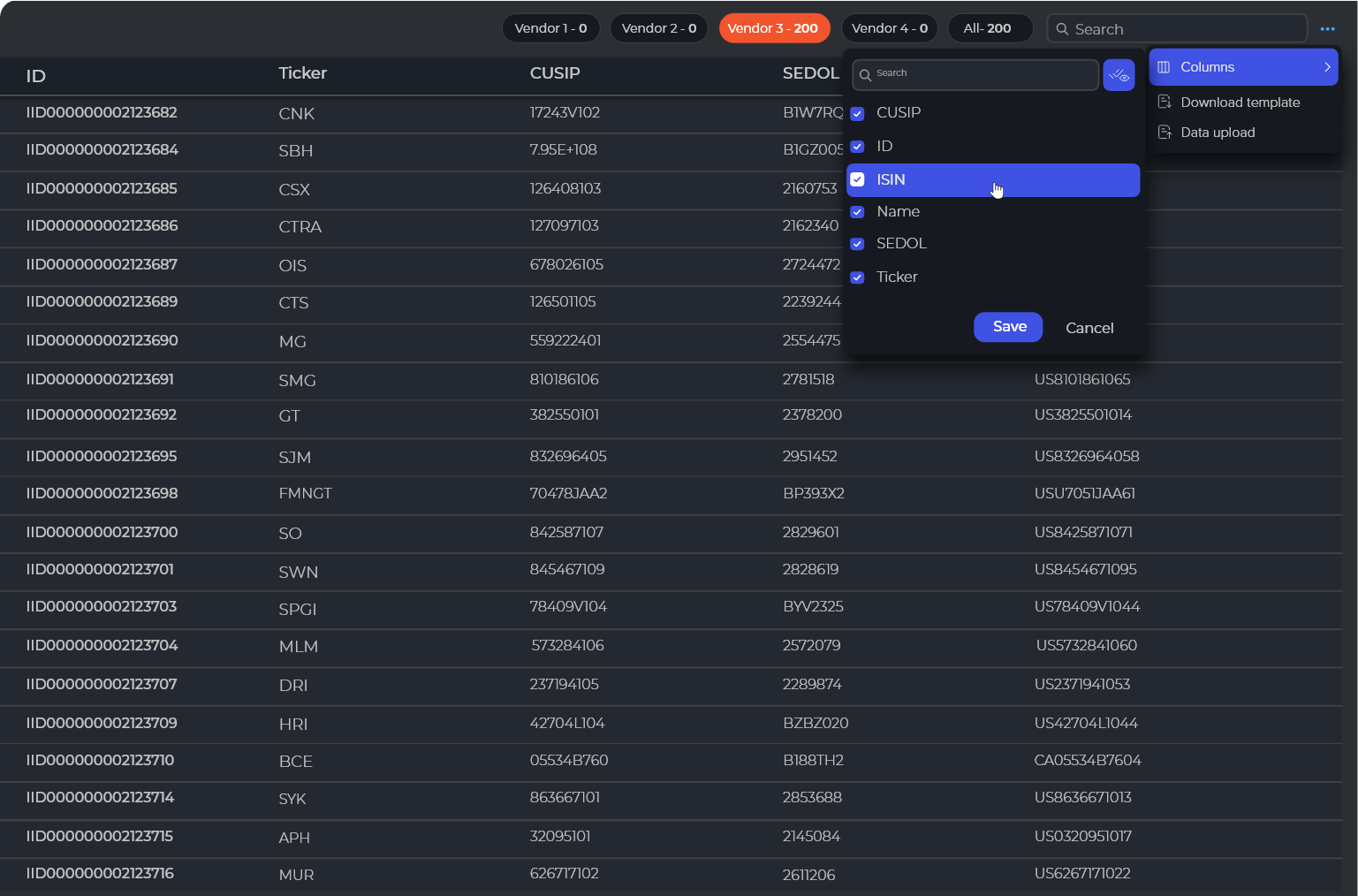

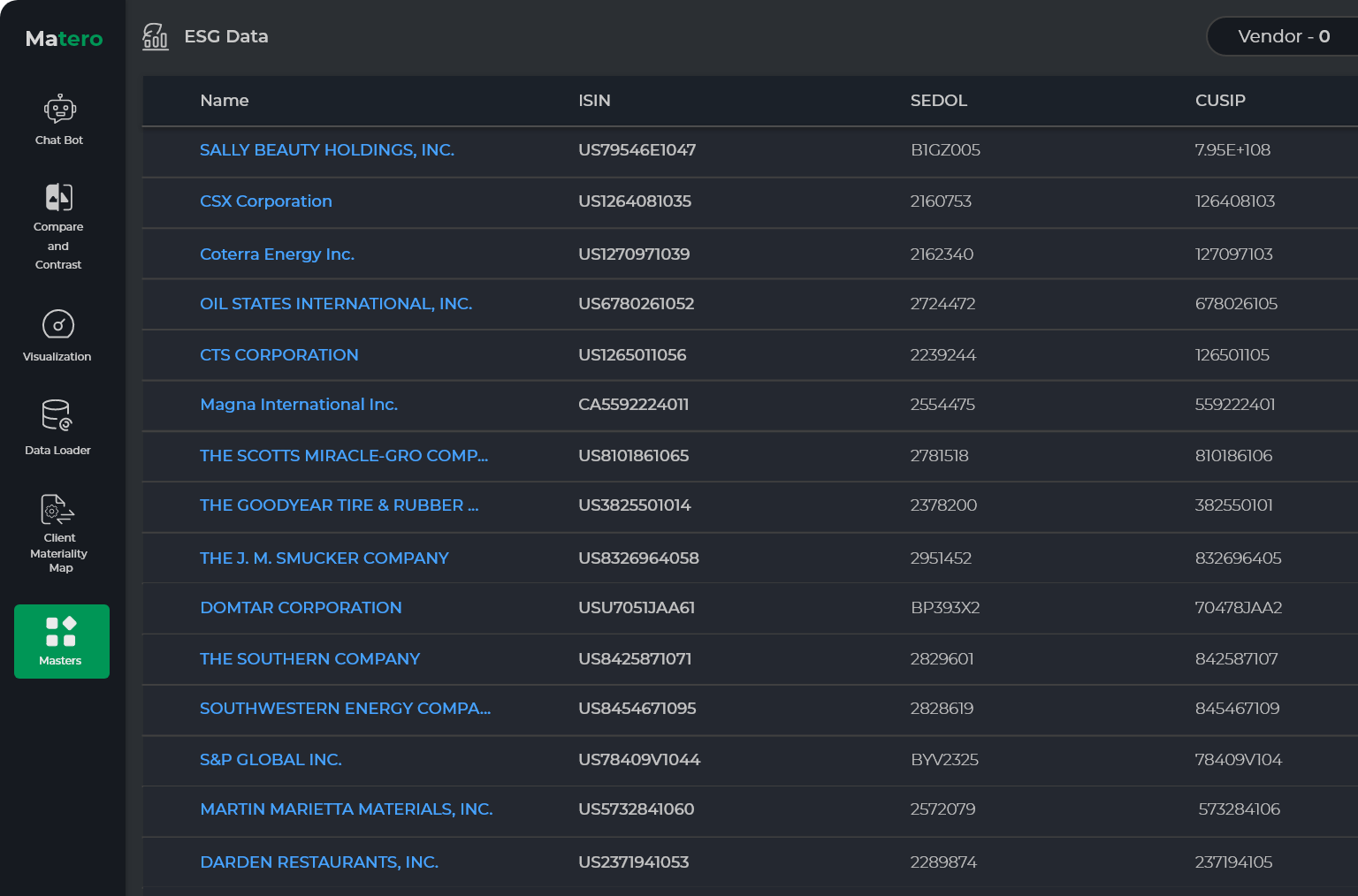

Centralized data sets

Discover alpha signals from your current data by having Matero uncovering hidden relationships between financial, ESG, stewardship datasets

Compare and Contrast

- Quickly and easily screen thousands of pages from companies’ reports to track progress and contrast narratives from multiple periods

- Compare multiple reports from the same company to track progress or compare reports from peers to identify key differences

Types of Clients Leveraging Matero

Asset Managers

Pension Funds

Hedge Funds

Sovereign Wealth Funds

Investment Banks

Sell-side Research Providers

Frequently Asked Questions

What is Matero?

Matero is Singapore-based fintech startup providing an AI copilot and a centralized database platform. Our solution supports materiality assessments, ESG research, engagement milestone tracking, benchmarking, and much more, empowering investment teams to make data-driven decisions.

What makes Matero different?

Matero stands out by addressing the core challenge of ESG data management. Investment teams and ESG professionals often struggle to integrate diverse datasets, wasting money and time in the process. Our advanced AI language models and database mapping expertise enable users to quantify the materiality of both financial and ESG factors seamlessly, turning complex data into actionable insights and truly leverage the full potential of their datasets and vendors.

What can I use Matero for?

Imagine a platform where you can seamlessly connect all your vendors' financial and ESG data, supported by an AI analyst that can instantly answer complex questions like:

What are the top 10 companies with the highest water intensity (water withdrawal in cubic meters per revenue unit in millions of U.S. dollars) in the MSCI ACWI?

Which country has the most companies with credit policies related to biodiversity?

From my portfolio holdings, which are the three top sub-industries making the most aggressive efforts to utilize clean energy sources?

Matero enables asset managers, asset owners, and corporations to tackle these critical challenges by transforming how they engage with ESG and financial data. Our platform empowers clients to unlock the true value of their datasets, ensuring informed decision-making without the overwhelm of excessive information.

How does Matero ensure data accuracy, privacy, and security?

At Matero, we prioritize both data accuracy and security. Our platform implements rigorous validation processes to ensure the integrity of our datasets. Additionally, Matero can be locally installed, allowing you to keep proprietary and sensitive data in-house, safeguarding it from exposure to external parties. This ensures that your valuable information is not only secure but also not used to train other language models, providing you with peace of mind as you leverage ESG insights for your investment strategies.

Is Matero suitable for organizations of all sizes?

Absolutely! Matero is designed to meet the needs of a wide range of organizations, from small asset managers to large asset owners. Our scalable platform adapts to your specific requirements, ensuring that you can effectively leverage ESG data, regardless of your organization's AUM or complexity.

What kind of support does Matero offer to its clients?

Matero provides comprehensive support to ensure a smooth user experience. Our dedicated team offers training, ongoing technical assistance, and strategic guidance to help clients maximize the value of our platform and effectively integrate ESG analytics into their decision-making processes.